Posted: 22 Jan 2014 09:11 AM PST

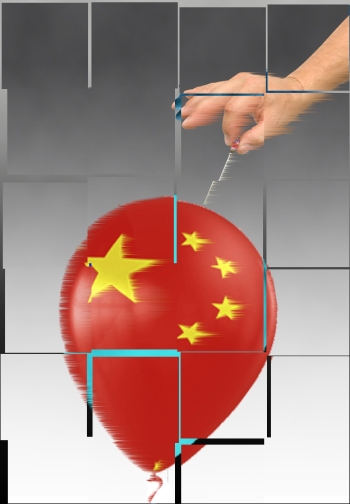

Did you know that financial institutions all over the world are warning that we could see a “mega default” on a very prominent high-yield investment product in China on January 31st?

We are being told that this could lead to a cascading collapse of the shadow banking system in China which could potentially result in “sky-high interest rates” and “a precipitous plunge in credit“.

In other words, it could be a

“Lehman Brothers moment” for Asia.

And since the global financial system is more interconnected today than ever before, that would be very bad news for the United States as well. Since Lehman Brothers collapsed in 2008, the level of private domestic credit in China has risen from $9 trillion to an astounding $23 trillion.

That is an increase of $14 trillion in just a little bit more than 5 years.

Much of that “hot money” has flowed into stocks, bonds and real estate in the United States. So what do you think is going to happen when that bubble collapses?

The bubble of private debt that we have seen inflate in China since the Lehman crisis is unlike anything that the world has ever seen.

Never before has so much private debt been accumulated in such a short period of time. All of this debt has helped fuel tremendous economic growth in China, but now a whole bunch of Chinese companies are realizing that they have gotten in way, way over their heads.

In fact, it is being projected that Chinese companies will pay out the equivalent of approximately a trillion dollars in interest payments this year alone. That is more than twice the amount that the U.S. government will pay in interest in 2014.

Corruption, embezzling, drug-related crimes, and even theft on a large enough scale can all get you killed in China. Last month, a Chinese telecommunications executive was sentenced to death for accepting bribes. In March, China sparked a diplomatic incident by executing three Filipino citizens on drug trafficking charges. Other non-violent crimes punished by death have included, for example, 43-year-old Du Yimin, killed in March 2008 after he borrowed $100 million for investment schemes that never panned out.

Over the past several years, the U.S. Federal Reserve, the European Central Bank, the Bank of Japan and the Bank of England have all been criticized for creating too much money. But the truth is that what has been happening in China surpasses all of their efforts combined.

- China’s Fiat Credit ‘Debit’ Bubble Unprecedented In Modern World History

- Rothschild Too Big To Jail? Russia, Egypt, Iceland, Iran, China, & Hungary Say No!

Overall credit has jumped from $9 trillion to $23 trillion since the Lehman crisis. “They have replicated the entire U.S. commercial banking system in five years,” she said.The ratio of credit to GDP has jumped by 75 percentage points to 200pc of GDP, compared to roughly 40 points in the US over five years leading up to the subprime bubble, or in Japan before the Nikkei bubble burst in 1990. “This is beyond anything we have ever seen before in a large economy. We don’t know how this will play out. The next six months will be crucial,” she said.

As with all other things in the financial world, what goes up must eventually come down.

And right now January 31st is shaping up to be a particularly important day for the Chinese financial system. The following is from a Reuters article…

The trust firm responsible for a troubled high-yield investment product sold through China’s largest banks has warned investors they may not be repaid when the 3 billion-yuan ($496 million) product matures on Jan. 31, state media reported on Friday.Investors are closely watching the case to see if it will shatter assumptions that the government and state-owned banks will always protect investors from losses on risky off-balance-sheet investment products sold through a murky shadow banking system.

If there is a major default on January 31st, the effects could ripple throughout the entire Chinese financial system very rapidly. A recent Forbes article explained why this is the case…

A WMP default, whether relating to Liansheng or Zhenfu, could devastate the Chinese banking system and the larger economy as well.In short, China’s growth since the end of 2008 has been dependent on ultra-loose credit first channeled through state banks, like ICBC and Construction Bank, and then through the WMPs, which permitted the state banks to avoid credit risk.Any disruption in the flow of cash from investors to dodgy borrowers through WMPs would rock China with sky-high interest rates or a precipitous plunge in credit, probably both. The result? The best outcome would be decades of misery, what we saw in Japan after its bubble burst in the early 1990s.

The big underlying problem is the fact that private debt and the money supply have both been growing far too rapidly in China. According to Forbes, M2 in China increased by 13.6 percent last year…

And at the same time China’s money supply and credit are still expanding. Last year, the closely watched M2 increased by only 13.6%, down from 2012’s 13.8% growth. Optimists say China is getting its credit addiction under control, but that’s not correct. In fact, credit expanded by at least 20% last year as money poured into new channels not measured by traditional statistics.

Overall, M2 in China is up by about 1000 percent since 1999. That is absolutely insane.

And of course China is not the only place in the world where financial trouble signs are erupting. Things in Europe just keep getting worse, and we have just learned that the largest bank in Germany just suffered ” a surprise fourth-quarter loss”…

Deutsche Bank shares tumbled on Monday following a surprise fourth-quarter loss due to a steep drop in debt trading revenues and heavy litigation and restructuring costs that prompted the bank to warn of a challenging 2014.Germany’s biggest bank said revenue at its important debt-trading division, fell 31 percent in the quarter, a much bigger drop than at U.S. rivals, which have also suffered from sluggish fixed-income trading.

Get Outside The Rothschild Matrix!

- Silver

- Breaking => $10 Billion Bitcoin Goes Live On Overstock!

- Commercial Developer Selling $7.5 Million Mansion For BitCoin

- When Saving Interest Rates Go Negative: Time For New Medium Of Exchange Bitcoin & Quark!

- Bitcoin & 1,000 New Merchants Per Week Utilizing New Medium Of Exchange: Bitcoin ATMs Go Mainstream!

If current trends continue, many other big banks will soon be experiencing a “bond headache” as well. At this point, Treasury Bond sentiment is about the lowest that it has been in about 20 years. Investors overwhelmingly believe that yields are heading higher.

If that does indeed turn out to be the case, interest rates throughout our economy are going to be rising, economic activity will start slowing down significantly and it could set up the “nightmare scenario” that I keep talking about.

But I am not the only one talking about it.

In fact, the World Economic Forum is warning about the exact same thing…

Fiscal crises triggered by ballooning debt levels in advanced economies pose the biggest threat to the global economy in 2014, a report by the World Economic Forum has warned.Ahead of next week’s WEF annual meeting in Davos, Switzerland, the forum’s annual assessment of global dangers said high levels of debt in advanced economies, including Japan and America, could lead to an investor backlash.This would create a “vicious cycle” of ballooning interest payments, rising debt piles and investor doubt that would force interest rates up further.

Rothschild Cabal’s U.S. Congress, Pre-empts Fallout To Their Benefit With Basel III ~ An Act Of Treason Against The American People.

- Kiss Your Savings Including IRAs Good-Bye: ‘Bail Ins R Here’ ~ On July 2, 2013 Dodd Frank ~ Basel III Implemented.

- Dark Legislation ~ Dodd Frank & Basel III Enacted Treason Against The United States July 2, 2013: Wealth Funneled Into Rothschild’s [BOE] Bank Of England.

So will a default event in China on January 31st be the next “Lehman Brothers moment” or will it be something else?

In the end, it doesn’t really matter. The truth is that what has been going on in the global financial system is completely and totally unsustainable, and it is inevitable that it is all going to come horribly crashing down at some point during the next few years.

It is just a matter of time.

Comments

Yes and have you seen the stock market recently, china and other 3rd world countries markets and currencies are failing,.China and others have closed the doors on banks for a short time you cannot get your money out if its over a certain amount. The western world is soon to follow, I am sure, already the USA has put a limit on the amount you can take out for over seas. I think things are going to crash soon but at the moment the US$ is still strong. Adonai

thanks for sharing Rev.Joshua.

this is a wow wow wow for me to read.

i feel that there is a lot going on """behind the curtain of the puppet masters quarters", and china must not be to happy about the the gold plated tungsten bars they receive from the fed.reserve owners for starters. then there was the gold certificates bonds that were not honored when these bond came to maturely and wanted to cash in.

things are rocking and rolling for the elites, especially with so many of us becoming awake and aware of their tactics, and their lack of honor they don't seem to show China

blessings to all of us for we are all one